Featured

M&t Loan Rates

Here are the key features of Unsecured Loans from MT. 339 - 1399 APR Minimum Loan Amount.

M T Mortgage Rates And Calculator Home Loans Online Banking

M T Mortgage Rates And Calculator Home Loans Online Banking

Adjustable-rate mortgages from MT Bank come with a minimum down payment of 5 and its fixed-rate mortgages have an even lower 3 minimum.

M&t loan rates. If your APR is reduced to 949 because of the rate discount that knocks off over 300 in interest. Business Installment Loan 12 to 60 month term loan for longer term financing. M.

MT Bank auto loans. This account comes with premiums and discounts on other banking services such as when opening a MT Select CD or taking out a loan. The minimum that can be obtained for one concluded loan agreement is 250 rubles.

Finance your car with APRs starting as low as 339 to 1399. The main cost to worry about is your interest rate. How to Make a Payment Learn the convenient ways to make a payment on your MT loan line or credit card.

Loan amounts starting at 2000. Marine Recreational Vehicle Loans Whether youre dreaming of open waters or the open road MT Bank offers boat loans RV loans motorcycle loans and other recreational loans at competitive rates to help take you where you want to go. Your APR can vary depending on several factors such as your credit score.

APRS between 394 and 1284. With that rate youd pay over 6800 in interest on the loan. Up to 7 years.

APRs start at 394 although several conditions must be met in order to receive this lowest advertised rate. Interest rates are fixed so your payment will never change during the life of the loan. It costs you nothing to use MT banks referral links to apply for a Sallie Mae loan and Sallie Mae doesnt charge application-related fees or prepayment penalties.

Find out what your credit score is and whether there is any false or inaccurate information in your credit history with these credit monitoring tools. A secured loan will likely yield a lower interest rate after factoring in the banks relationship discount but starting APRs arent provided online. Learn How to Pay Your MT Loan.

In This Section Unsecured Loans Get extra cash with no collateral required to consolidate high-interest balances finance a big purchase or cover miscellaneous expenses. MT Bank auto loans could be great if you already bank with this northeastern institution. Make a Loan Payment.

MT Bank offers both unsecured and secured loans. Fixed rates stay the same over the life of your loan ranging from 574 to 1185 for undergraduates and 624 to 902. M.

How much do MT Bank student loans cost. Meanwhile due to the fact that they are on a deal loan agents are not subject to monthly bank loan plans that are established for regular loan specialists. But youll have to look elsewhere if youre interested in refinancing.

Conventional mortgages from MT Bank have a max amount of 548250. MT Bank Loan Specifics. The more money you keep in your checking account the higher interest rate.

Rates and terms at a glance. The amount of the loan in the loan agreement may affect the amount of the agents earnings. The information provided assumes the purpose of the loan is to purchase a property with a loan amount of 225000 and an estimated property value of 375000.

MT Banks unsecured personal loan comes with an interest rate of 849 to 1124 APR. The property is located in NY and is within Erie county. This is MT Banks top of the line checking account that anyone age 18 or older can apply for.

Business LoanLine of Credit Rates. Already have an auto loan with MT. Is it safe to take out a loan through MT Bank loans.

Like most private student loan providers Sallie Mae offers fixed and variable rates. You can borrow between 2000 and 25000. MT Bank offers financing for new and used cars from a dealer or a private party.

Your loan will currently have an APR between 749 and 1249. We offer a number of different ways to make your loan payment so you can choose the most convenient method for you. M.

With a variety of personal loans from MT Bank you can choose the terms that are right for you get great rates and enjoy a fast approval process. With loans starting at 2000 this lender offers member discounts on top of competitive rates. M.

Borrowers can research and select from a number of mortgage options when working with MT Bank including. This account also offers premium interest rates by MT Banks standards and tiered interest. Offered in 30-year and 15-year terms the fixed rate loan carries a locked-in interest rate that does not fluctuate with the economy ensuring homeowners know what.

Rates are good as of. A fixed-rate mortgage is best for consumers who are looking long term. Terms up to 84 months.

The property is an existing single family home and will be used as a. The total cost of your loan as well as the term you qualify for will depend on how much you borrow and your credit. MT Bank Auto Loans offers a fixed APR car loan product that ranges from 364 APR up to 1429 APR.

Current MT Bank Prime Rate.

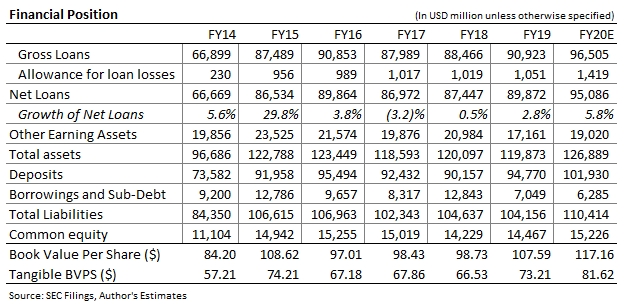

M T Bank S Earnings Outlook Appears Bleak Due To Provisions Nyse Mtb Seeking Alpha

M T Bank S Earnings Outlook Appears Bleak Due To Provisions Nyse Mtb Seeking Alpha

M T Auto Loan Rates And Calculators

M T Auto Loan Rates And Calculators

M T Bank Personal Loans 2021 Review Should You Apply Mybanktracker

M T Bank Personal Loans 2021 Review Should You Apply Mybanktracker

M T Mortgage Rates And Calculator Home Loans Online Banking

M T Mortgage Rates And Calculator Home Loans Online Banking

![]() Personal Mortgages Loans M T Bank

Personal Mortgages Loans M T Bank

M T Bank A Strong Bet For The Gurufocus Com

M T Bank A Strong Bet For The Gurufocus Com

M T Auto Loan Rates And Calculators

M T Auto Loan Rates And Calculators

Mortgage Loan Rates M T Mortgage Loan Rates

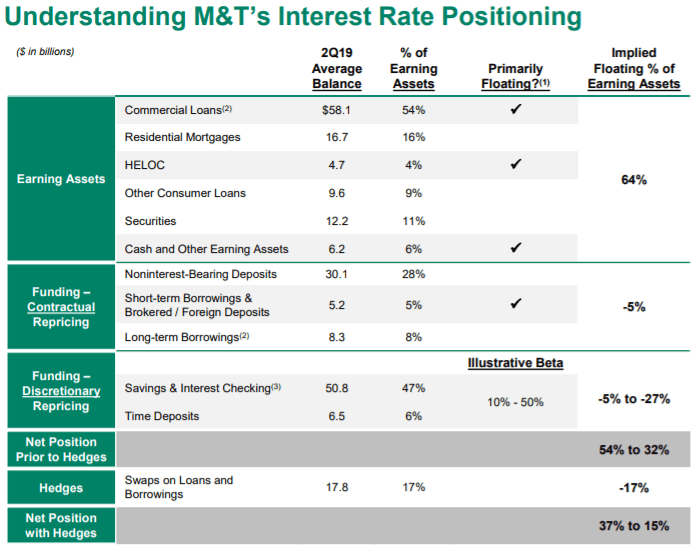

M T Bank Too Soon To Call The Turn Nyse Mtb Seeking Alpha

M T Bank Too Soon To Call The Turn Nyse Mtb Seeking Alpha

M T Bank A Strong Bet For The Gurufocus Com

M T Bank A Strong Bet For The Gurufocus Com

M T Auto Loan Rates And Calculator Online Banking Information Guide

M T Auto Loan Rates And Calculator Online Banking Information Guide

Comments

Post a Comment