Featured

Are Section 199a Dividends Taxable

If you are an eligible taxpayer you may be able to deduct up to 20 of your combined REIT dividends and PTP income under section 199A. Estates and trusts are subject to the 157500 threshold same as single taxpayers and this threshold is measured at the trust level without considering any distribution deduction for Distributable Net Income DNI distributed to beneficiaries.

Sec 199a Dividends Paid By A Ric With Interest In Reits And Ptps

Sec 199a Dividends Paid By A Ric With Interest In Reits And Ptps

The other important aspect of section 199A relates to a deduction thats connected with real estate investment trust REIT dividends and qualified publicly traded partnership PTP earnings.

Are section 199a dividends taxable. Any dividend income equivalent to a dividend or payment in lieu of dividends described in section 954c1G. Any amount described in section. Section 199A dividends A portion of the dividends from the American Funds listed below may be eligible for the 20 qualified business income deduction under Section 199A to the extent that the individual taxpayer has met the 46-day holding period requirement.

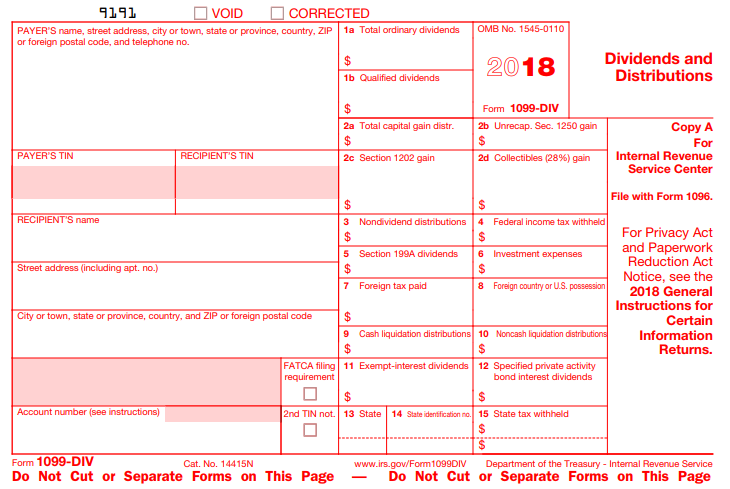

Box 5 section 199A dividends must be completed to report section 199A dividends paid to the recipient. In accordance with the Internal Revenue Code cash distributions made on January 29 2021 with a record date of December 31 2020 January Dividends are treated as received by shareholders on December 31 2020 to the extent of 2020 earnings and included on Form 1099-DIV. New box 5 section 199A dividends.

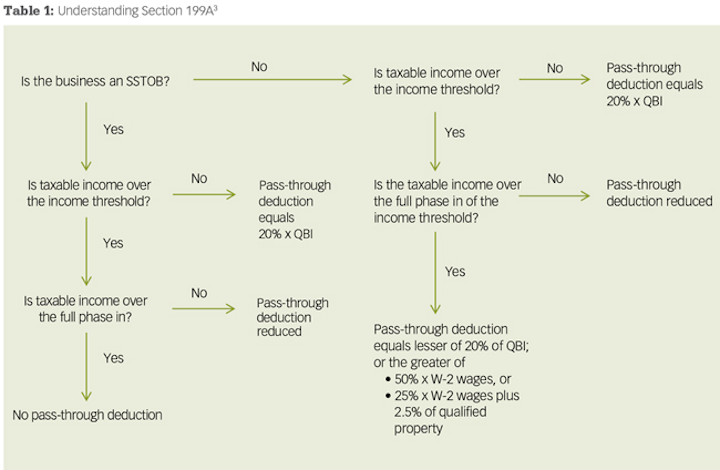

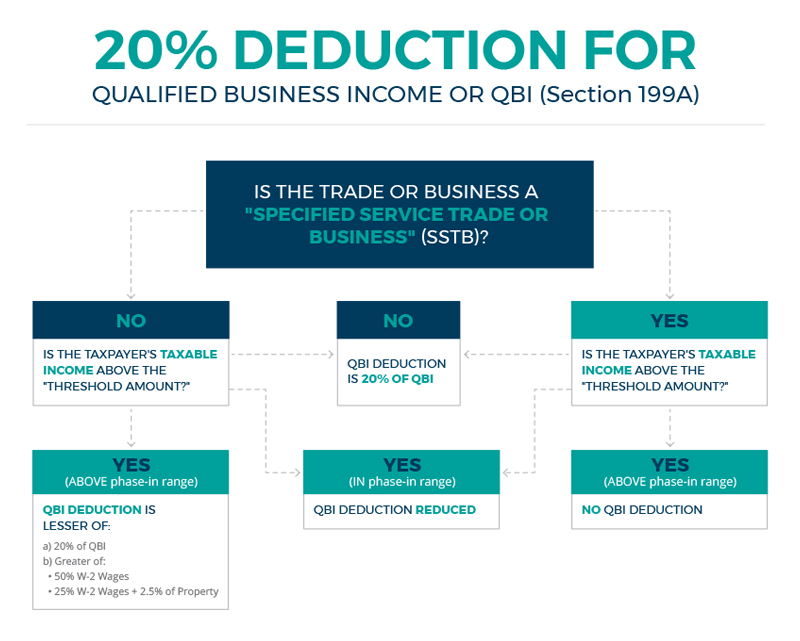

Read more on Section 199A There are additional limitations and phase-in rules that apply to this deduction. Married professionals with taxable incomes greater than 315000 see their Section 199A deduction phase-out too for the same reason for these people the phase-out hits 100 once taxable. The term Section 199A Dividend doesnt dictate how these dividends are taxed - but rather if that incomeis qualified fro section 199A deduction.

According to the IRS. The amount of a RICs Section 199A Dividends for a taxable year would be limited to the excess of the RICs qualified REIT dividends for the taxable year over allocable expenses. Section 199A dividends.

Ask Your Own Tax. A RIC that receives qualified REIT dividends in a tax year may generally pay section 199A dividends for that year which certain shareholders of the RIC that meet holding period requirements may treat as qualified REIT dividends for purposes of section 199A. Importantly the proposed regulations provide only for conduit treatment of a RICs qualified REIT dividends.

The deduction is also called the Section 199A deduction. Therefore shareholders will be eligible to treat 20000 as Sec. The amount in box 5 of 1099-DIV is considered Qualified Business Income QBI which is eligible for a 20 tax deduction.

199A dividends in 2018 and 2000 as Sec. The amount paid is also included in box 1a. A portion of our ordinary dividend distribution is considered a qualified REIT dividend for purposes of Section 199A.

It was added to the 1099-DIV this year in order to aid in the calculation of Section 199A also known as the Qualified Business Income Deduction. The amount of section 199A dividends that a RIC may pay for a tax year is limited to the amount of qualified REIT dividends includible in the RICs. 199A dividends in 2019.

There is no need for the taxpayer to be in a trade or business and there are no limitations based on taxable income. Considerations for conduit treatment for RICs with qualified PTP income. How these dividends are taxed - is based on whether they are ordinary or qualified dividends.

Ordinary REIT dividends are taxed at ordinary rates as opposed to the lower qualified dividend rates. Qualified dividends from real estate investment trusts REITs Section 199A dividends and ordinary income from publicly traded partnerships qualify for the Section 199A deduction. Section 199A enacted as part the Tax Cuts and Jobs Act TCJA allows individual taxpayers and certain trusts and estates to.

Single professionals with taxable incomes greater than 157500 see their Section 199A deduction phase-out because theyre professionals the phase-out is 100 once taxable income equals 207500. WASHINGTON The Internal Revenue Service today issued final regulations permitting a regulated investment company RIC that receives qualified real estate investment trust REIT dividends to report dividends the RIC pays to its shareholders as section 199A dividends. For example if a taxpayer has REIT dividends of.

Shareholders must take holding period requirements into account when computing their Sec. All Section 199A dividends are taxed at the marginal tax rate and are eligible for the 20 deduction Qualified Dividends and Capital Gains Distributions are taxed at 0 for the 10 and 12. 199A deduction as described earlier.

2 The new Sec 199A rules allow a taxpayer to deduct 20 percent of the dividend amount against itself.

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

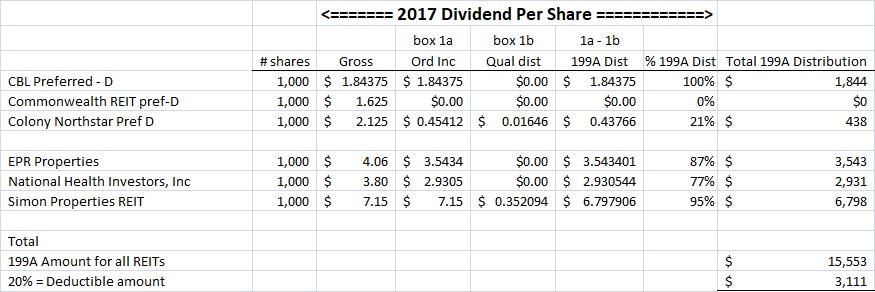

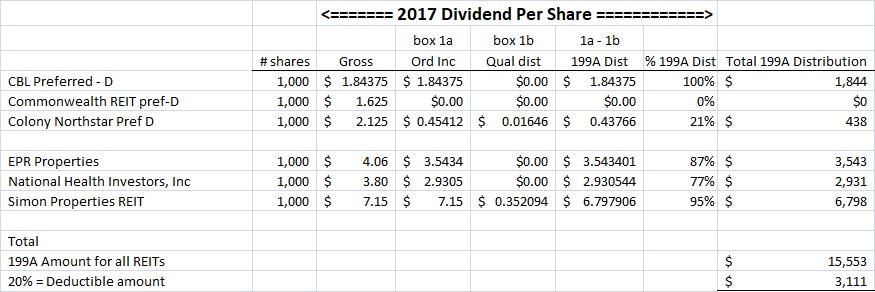

Section 199a Reit Deduction How To Estimate It For 2018 Seeking Alpha

Section 199a Reit Deduction How To Estimate It For 2018 Seeking Alpha

Icymi Proposed Regulations Clarify The Irc Section 199a Deduction The Cpa Journal

Icymi Proposed Regulations Clarify The Irc Section 199a Deduction The Cpa Journal

Section 199a And Entity Selection Dental Economics

Section 199a And Entity Selection Dental Economics

Section 199a Deduction Greenstone Fcs

Section 199a Deduction Greenstone Fcs

Section 199a Qualified Business Income Deduction Youtube

Section 199a Qualified Business Income Deduction Youtube

Qualified Business Income And Section 199a Verdeja De Armas Trujillo Llp Cpa Firm

Qualified Business Income And Section 199a Verdeja De Armas Trujillo Llp Cpa Firm

Section 199a Reit Deduction How To Estimate It For 2018 Seeking Alpha

Section 199a Reit Deduction How To Estimate It For 2018 Seeking Alpha

Do I Qualify For The 199a Qbi Deduction Myra Personal Finance For Immigrants

Do I Qualify For The 199a Qbi Deduction Myra Personal Finance For Immigrants

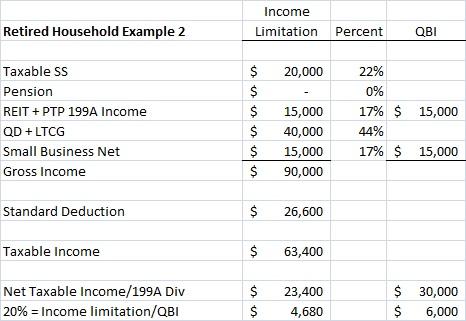

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Series On Tax Reform New Deduction Pass Through Entities Sikich Llp

Series On Tax Reform New Deduction Pass Through Entities Sikich Llp

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Section 199a Qbi Deductions For Reits Vs Direct Real Estate

Section 199a And The 20 Deduction New Guidance Basics Beyond

Section 199a And The 20 Deduction New Guidance Basics Beyond

Comments

Post a Comment