Featured

- Get link

- X

- Other Apps

Huntington Bank Dividend

It currently pays a 015 per share quarterly dividend which comes out to a 5 yield. Cost synergies are anticipated to be around 490 million or 37 of TCF Financials non-interest expenses.

Huntington Bancshares A Sell Off Opportunity Nasdaq Hban Seeking Alpha

Huntington Bancshares A Sell Off Opportunity Nasdaq Hban Seeking Alpha

October 2021 1600 Strike CALL.

Huntington bank dividend. Sign up for online investing. Return Before Taxes After Taxes 0 25 5 75. Historical dividend payout and yield for Huntington Bancshares HBAN since 1992.

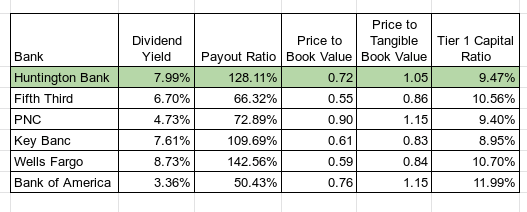

This compares to the Banks - Midwest industrys yield of. See the Dividend dates for Huntington Bancshares HBAN Stock Dividend Yield Ex-Dividend Dates History and Payout Ratio. LTM stands for Last Twelve Months and implies that the calculation uses the dividends paid over the last twelve months.

The 154-year-old bank has 120 billion in assets with 800 branches in seven Midwestern states. In comparison to other stocks in the mid-sized revenue class where its estimated gain based on our dividend discount model price relative to its current share price is greater than 7668 of companies in the same revenue class. Huntington taking steps to raise dividend reveals where Pittsburgh stands with new round of branch cuts.

The current TTM dividend payout for Huntington Bancshares HBAN as of May 20 2021 is 060. 8 Zeilen Huntington Bancshares NASDAQHBAN Dividend Information Huntington Bancshares pays an annual. Huntington Bancshares Incorporated HBAN dividend summary.

Yield payout growth announce date ex-dividend date payout date and Seeking Alpha Premium dividend score. Huntington Bancshares HBAN Declares 015 Quarterly Dividend. Top holders of HBAN among the universe of 13F filers covered at Holdings Channel.

Huntington Bancshares is the holding company for Columbus Ohio-based Huntington Bank. Last Ex-Dividend Date 061621. It divides the Forward Annualized Dividend by FY1 EPS.

The regional bank holding company is currently shelling out a dividend of 011 per share with a dividend yield of 284. 57 Zeilen There are typically 4 dividends per year excluding specials and the dividend cover is. 1517 Annualized YieldBoost.

The amount of revenue Huntington Bancshares Inc earns annually is around 4 billion. Huntington Bancshares Inc HBAN Dividends - XNAS Morningstar. Huntington provides online banking solutions mortgage investing loans credit cards and personal small business and commercial financial services.

Fwd Payout Ratio is used to examine if a companys earnings can support the current dividend payment amount. Per Huntingtons expectations the deal is likely to be 18 accretive to earnings by. President of Huntington National Banks Western Pennsylvania and.

52 Week Dividend 060. Table of the minimum sale price before taxes needed to earn the desired rate of return. The current dividend yield for Huntington Bancshares as of May 20 2021 is 384.

Huntington Bancshares HBAN Raises Quarterly Dividend 71 to 015. Relative to its peers in the mid-sized revenue class it has a dividend yield higher than 917.

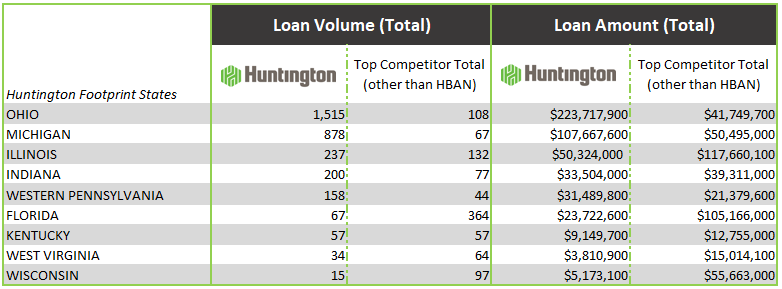

Huntington Bank Takes Top Spot Nationally For Sba 7 A Loan Origination By Volume For Third Consecutive Year

Huntington Bank Takes Top Spot Nationally For Sba 7 A Loan Origination By Volume For Third Consecutive Year

Huntington Bank Stock Dividend History

Huntington Bank Stock Dividend History

Huntington Bank Stock Dividend History

Huntington Bank Stock Dividends

Huntington Bancshares Incorporated Declares Quarterly Cash Dividends On Its Common And Preferred Stocks

Huntington Bancshares Incorporated Declares Quarterly Cash Dividends On Its Common And Preferred Stocks

Huntington Bancshares A Solid Midwestern Regional Bank Nasdaq Hban Seeking Alpha

Huntington Bancshares A Solid Midwestern Regional Bank Nasdaq Hban Seeking Alpha

Hban Huntington Bancshares Inc Dividend History Dividend Channel

Huntington Bancshares Inc Hban Dividends

Huntington Bancshares Inc Hban Dividends

Huntington Bank Stock Dividend History

Huntington Bancshares Is Oversold Nasdaq

Huntington Bancshares Is Oversold Nasdaq

Huntington Bank Stock Dividend History

Huntington Bank Stock Dividend History

Huntington Bank Stock Dividend History

Comments

Post a Comment