Featured

Consumer Use Tax

Compute consumers use tax based on the purchase price of the goods. What items are subject to consumer use tax.

Sales Tax Vs Sellers Use Tax Vs Consumers Use Tax All About Tax Compliance Youtube

Sales Tax Vs Sellers Use Tax Vs Consumers Use Tax All About Tax Compliance Youtube

The use tax protects retailers located in the state or municipality because it removes the incentive for consumers to shop outside that locality in order to avoid paying the sales tax.

Consumer use tax. For more information about the sales and use tax look at the options below. When the buyer or the consumer remits sales tax its called consumer use tax. The state use tax rate is 4225.

If you have questions or would like additional information you may call our Customer Service Center at 1-800-400-7115 or your local CDTFA office. Please see the Use Tax. Every state that has a sales tax also has a companion tax for purchases made where sales tax is not charged.

The amount of use tax due on a transaction depends on the combined local and state use tax rate in effect at the Missouri location where the tangible personal property is stored used or consumed. States dont generally do a great job of enforcing consumer use tax unless its on an expensive item. Confusingly some states refer to both consumer use tax and seller use tax simply as use tax When talking about a remote sellers obligation to collect tax some state tax authorities use the term sales tax This is likely because seller use tax is more of a.

Consumer Use Tax Return - Form 51A113O may be filed during the year each time you make taxable purchases. The use tax like the sales tax is assessed upon the end consumer of the tangible good or service but the difference is who calculates the tax and how it is accounted for. Consumer use tax is paid directly by the purchaser to the state department of revenue by filing a use tax return or in some states by including an amount on the income tax return filed each year with the state.

Cities and counties may impose an additional local use tax. Consumer use taxes are imposed by state and local governments for two reasons to prevent someone from evading a sales tax by buying goods or taxable services from a non-taxing state and shipping them into the state that imposes the sales tax. A purchaser must file a consumers use tax return if the cumulative purchases subject to use tax exceed 2000 in a calendar year.

Managing use tax manually is labor-intensive and prone to error. Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

About Consumer Use Tax. To be compliant with tax laws you must report and pay consumer use tax when sales tax is not collected by the seller on a taxable product. Unlike sales tax use tax can be triggered after a transaction based on how and where products are used by the buyer.

Consumer use tax is owed by a buyer when sales tax is not paid in full by the seller. Individuals without a permit who rarely make purchases subject to consumers use tax should pay their tax in one of the following ways. Managing use tax manually is labor-intensive and prone to error.

In Colorado this companion tax is called Consumer Use Tax. You can report and pay use tax on an annual basis at the same time you file your Kentucky individual income tax return. Automation provides a better smarter way than maintaining complicated spreadsheets or creating expensive custom solutions.

Covering events and issues from every neighborhood in Birmingham we take you inside the biggest happenings in your community. This is the standard Consumer Use Tax Return for businesses that do not sell dont require a sellers permit and report only Use taxes such as construction contractors and individuals who have not paid sales tax on their purchases. Consumer use tax is owed by a buyer when sales tax is not paid in full by the seller.

The 2000 filing threshold is not an exemption or exclusion. The state sales and use tax rate is 575 percent. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable.

Consumer use tax is imposed on every item that is subject to sales tax if the item had been. How is consumer use tax paid. An individual who purchases a boat or an aircraft must report the tax on Form E-555 Boat and Aircraft Use Tax Return.

Counties and regional transit authorities may levy additional sales and use taxes. In addition to the use tax line found on the Sales and Use Tax returns and the Consumer Use Tax return for businesses the Department provides three additional options for individuals to report their use tax. Consumer use tax is paid directly by the purchaser to the state department of revenue by filing a use tax return or in some states by including an amount on the income tax return filed each year with the state.

See instructions below. If you hold a California consumer use tax account you are required to report purchases subject to use tax directly to us and may not report the tax on your income tax return. Use tax is imposed on the storage use or consumption of tangible personal property in this state.

Unlike sales tax use tax can be triggered after a transaction based on how and where products are used by the buyer. If you purchase tangible personal property for use in Iowa and the seller does not charge you Iowa tax on the purchase you owe a 6 tax known as the consumers use tax on the price of the purchase. Any individual who purchases food subject to the reduced rate of tax must report the 2 tax on Form E-554 Consumer Use Tax Return.

Once you have accumulated 2000 in taxable purchases in a calendar year you must pay tax on all your purchases subject to consumers use tax.

Http Www Rev State La Us Taxforms 540cu 04 A Pdf

Making Sense Of Consumer Use Tax Controllers Council

Making Sense Of Consumer Use Tax Controllers Council

Automate Consumer Use Tax In Procure To Pay Vertex Inc

What Is Consumer Use Tax Taxjar Blog

What Is Consumer Use Tax Taxjar Blog

What Is Consumer Use Tax Taxjar Blog

What Is Consumer Use Tax Taxjar Blog

Use Tax What Is It And What Are Your Business Owner Responsibilities

Use Tax What Is It And What Are Your Business Owner Responsibilities

Consumer Use Tax Nevada Fill Online Printable Fillable Blank Pdffiller

Consumer Use Tax Nevada Fill Online Printable Fillable Blank Pdffiller

Consumer Use Tax A Bane For Businesses

Consumer Use Tax What It Is And Why You Should Actively Manage It Webinar

Consumer Use Tax What It Is And Why You Should Actively Manage It Webinar

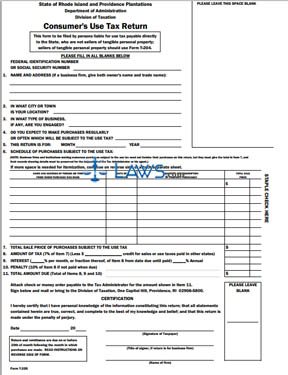

Free Form T205 Consumer Use Tax Return Free Legal Forms Laws Com

Free Form T205 Consumer Use Tax Return Free Legal Forms Laws Com

Consumer Use Tax Yes You Really Do Have To Report That Erp Software Blog

Consumer Use Tax Yes You Really Do Have To Report That Erp Software Blog

Consumer Use Tax A Bane For Businesses

Consumer Use Tax A Bane For Businesses

Sales Tax And Consumer Use Tax Compliance The Official Blog Of Taxslayer

Sales Tax And Consumer Use Tax Compliance The Official Blog Of Taxslayer

Comments

Post a Comment