Featured

- Get link

- X

- Other Apps

Usda Commercial Loan

You can visit the SBA website or your local SBA office to apply. A portion of the loan is guaranteed by the USDA.

Usda Business Loans What You Should Know Fora Financial Blog

Usda Business Loans What You Should Know Fora Financial Blog

What is the USDA Commercial Loan Program.

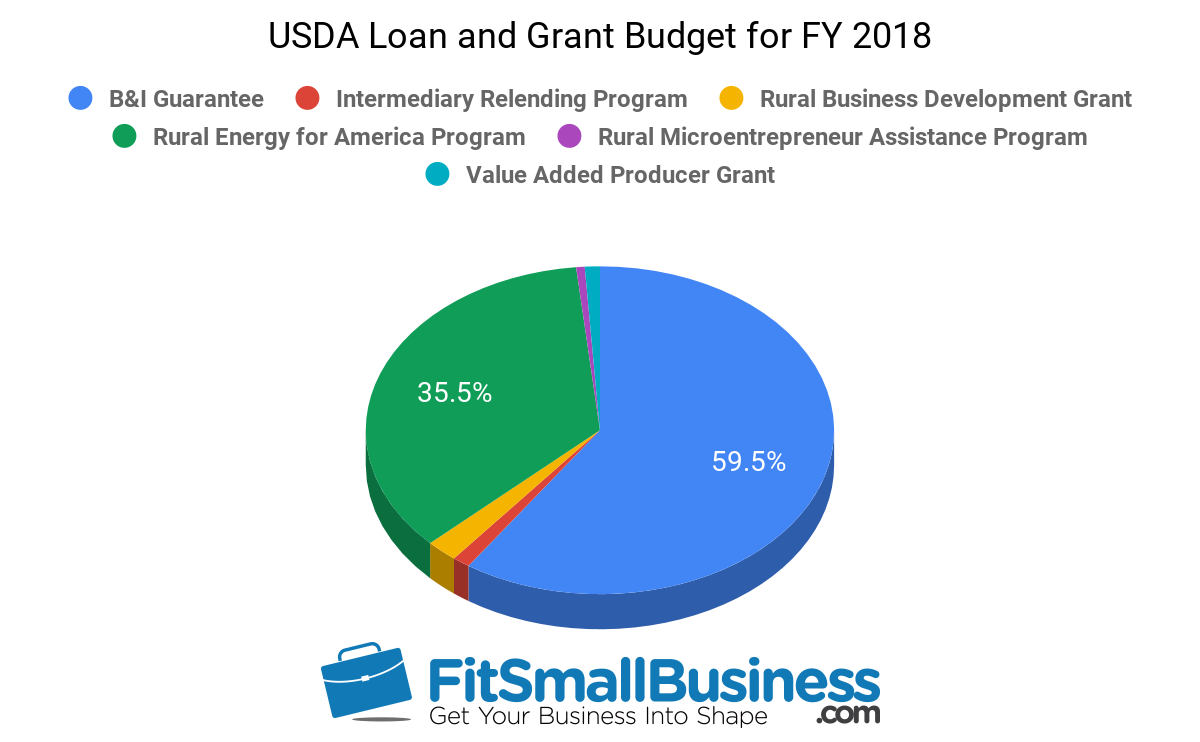

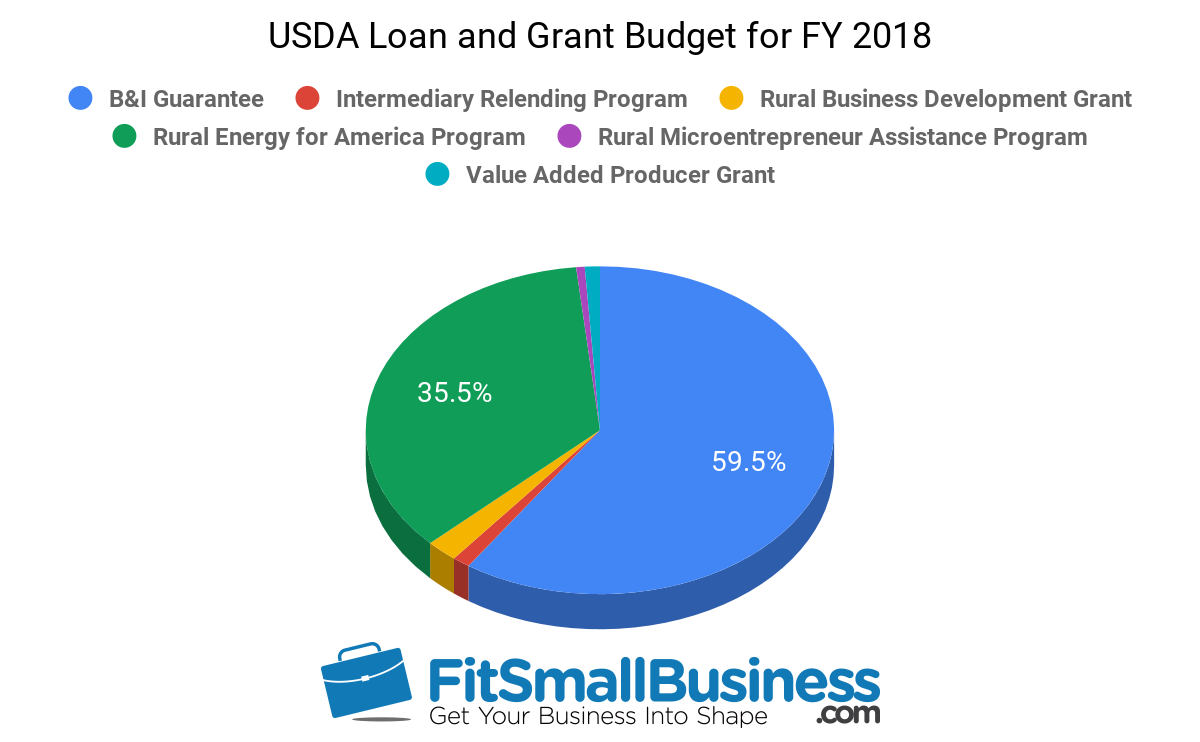

Usda commercial loan. From North Avenue Capital The USDA Business Industry BI Loan Program is an asset-based loan program designed to help credit-worthy rural businesses obtain needed credit to grow and create jobs in their local communities. USDA loans are commercial mortgage loans partially guaranteed by the United States Department of Agriculture USDA secured by owner-occupied real estate properties located in rural areas. Intermediaries can get up to 2 million on the first loan and up to 1 million for subsequent loans up to a combined 15 million.

USDA BI guaranteed loans may be used for a variety of business purposes. Department of Agriculture USDA. Loans covered by the debt relief program include operating loans farm ownership loans and conservation loans.

Loans loan guarantees and grants are available to individuals businesses cooperatives farmers and ranchers public bodies non-profit corporations Native American Tribes and private companies in rural communities. This program provides capital for small businesses that cannot qualify for SBA or bank loans. These include acquisition and development of land purchase of equipment machinery supplies and inventory business modernization etc.

2 The annual renewal fee is currently one-half of one percent 05 of the outstanding principal loan balance as of December 31st. The USDA helps create jobs and stimulates rural economies by providing financial backing for rural businesses and properties. How much can my business borrow.

The program is restricted to loans made by USDA and by private lenders with USDA repayment guarantees. The rate in effect at the time the loan is made will remain in effect for the life of the loan. Please note we are only licenced to work with properties that are zoned commercial.

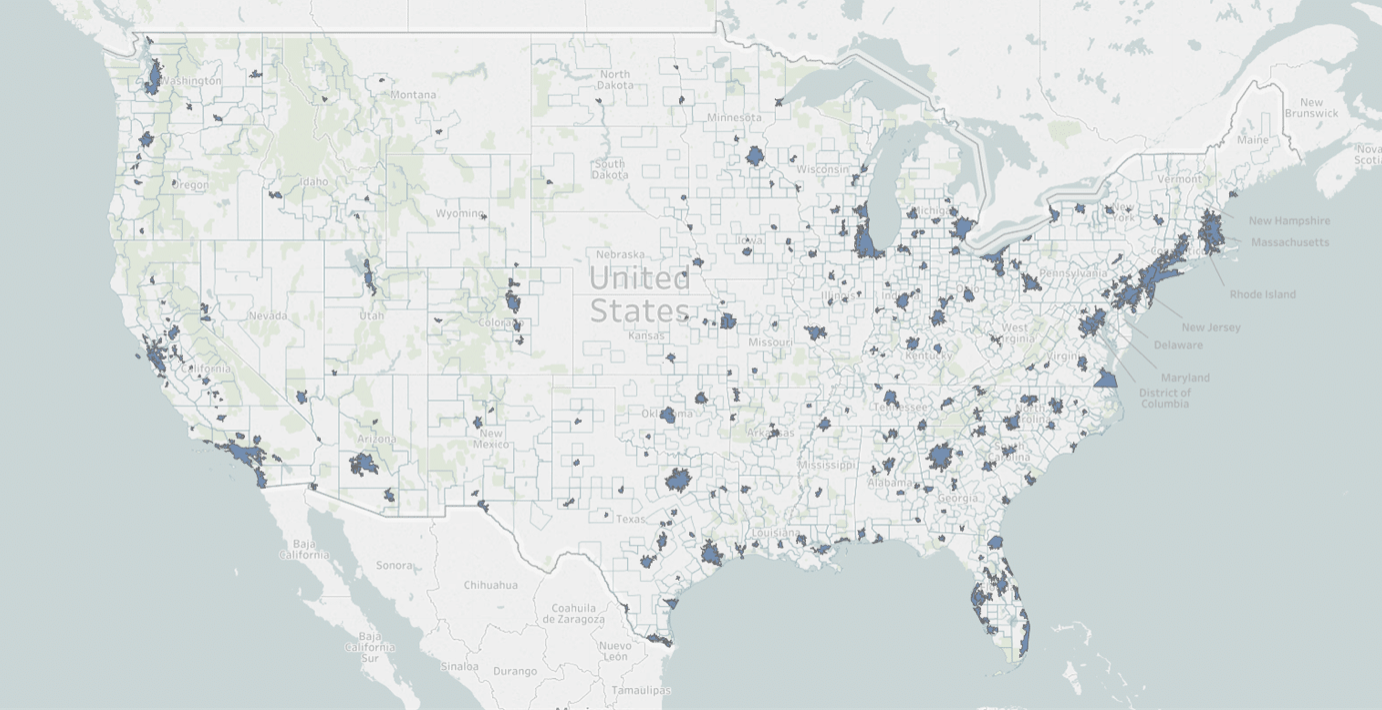

Small Business Administration SBA is offering Economic Injury Disaster Loans. Its primary purpose is to create and maintain employment and improve the economic climate in rural communities. It was created to help rural businesses grow and strengthen the economy of their local communities.

Loans from commercial lenders are not eligible if they did not include a USDA guarantee. The financial resources of the Business Programs are often leveraged with those of other public and private credit source lenders to meet business and credit needs in under-served areas. North Avenue Capital NAC is a specialized commercial lender exlusively lending loans backed by the USDA Rural Development Program nationwide.

Commercial nurseries forestry and aquaculture operations are eligible without these restrictions. USDA Business Loans formally referred to as USDA Business and Industry loans are business loans guaranteed by the US. The USDA commercial loan also known as the USDA Business Industry BI Loan Program is an asset-based loan guaranteed by the United States Department of Agriculture USDA.

We provide loans for the following properties but not limited to. Multifamily Office Retail Industrial HospitalsHealthcare Self-Storage Hotel Mixed Use and Churches. Intermediaries can also make interest-only repayments for the first three years.

If you qualify you can get up to 2 million and a 375 interest rate. What is the USDA Commercial Loan. To find a commercial loan suitable for your needs use our loan finder tool.

The reason why the Federal government is involved is because it wants to create and save rural jobs and improve the economic and environmental climate of rural communities. The USDA fixes interest rates at 1 and loan terms can last as long as. We partner with lenders who finance from 200000 to the USDA guaranteed maximum of 25 million.

The USDA Business and Industries Loan B I Loan Program is a Federal loan guarantee program that is designed to encourage the commercial financing of rural businesses. These loans are made by lenders such as banks or credit unions to businesses in rural areas. The loans are guaranteed through the USDA Business and Industry Loan BI Program.

These loans are very similar to Small Business Administration SBA loans but with a. So youve heard the USDA offers competitive business loans and you want in on that sweet rural funding. With USDA commercial loans you can bolster your rural business using a secure form of financing.

Types Of Commercial Loans. The USDA commercial loan also known as the USDA Business Industry BI Loan Program is an asset-based loan guaranteed by the United States Department of Agriculture USDA It was created to help rural businesses grow and strengthen the economy of their local communities. The USDA made investments of approximately 150 million USD in 2014 for small rural businesses.

We provide financing in all 50 states. USDA Commercial Loans USDA stands for United States Department of Agriculture. The renewal fee rate is set annually by Rural Development in a notice published in the Federal Register.

Usda Fsa Farm Loan Program Extension News

Usda Fsa Farm Loan Program Extension News

Https Www Rd Usda Gov Files Fl B And I Lender Guide 2017 Pdf

Usda Recognizes Greater Commercial Lending As 1 Business And Industry Lender In Top Commercial Lender Rankings Sponsored

Usda Recognizes Greater Commercial Lending As 1 Business And Industry Lender In Top Commercial Lender Rankings Sponsored

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Usda Business Loans Grants And Where To Apply

Usda Business Loans Grants And Where To Apply

Debunking Common Myths About Usda Commercial Loans

Debunking Common Myths About Usda Commercial Loans

Usda Commercial Loans Commercial Loan Direct

Usda Commercial Loans Commercial Loan Direct

Commercial Loans Blog Usda Commercial Loan

Commercial Loans Blog Usda Commercial Loan

Greater Commercial Lending Brokers First Ever Usda Cares Act Loan Business Wire

Greater Commercial Lending Brokers First Ever Usda Cares Act Loan Business Wire

Usda Commercial Loans Commercial Loan Direct

Usda Commercial Loans Commercial Loan Direct

Https Www Rd Usda Gov Files Bcp Bi Leap Leapfaqs Pdf

Sba Loans Every Business Owner Should Be Aware Of

Sba Loans Every Business Owner Should Be Aware Of

Usda B I Loan Program Ppt Download

Usda B I Loan Program Ppt Download

Comments

Post a Comment