Featured

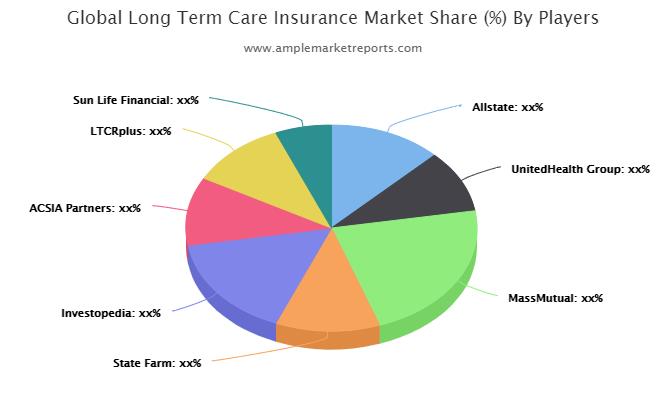

Long Term Care Insurance Market Share By Company

However when taking into account the average cost of long-term care. More than 100 insurers were selling policies.

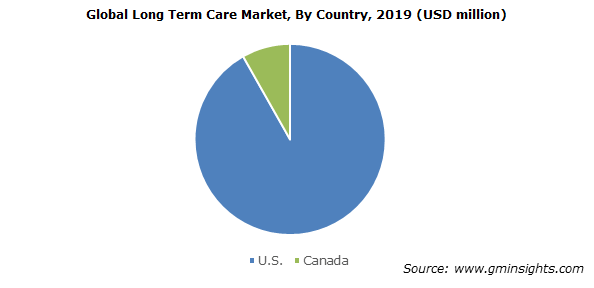

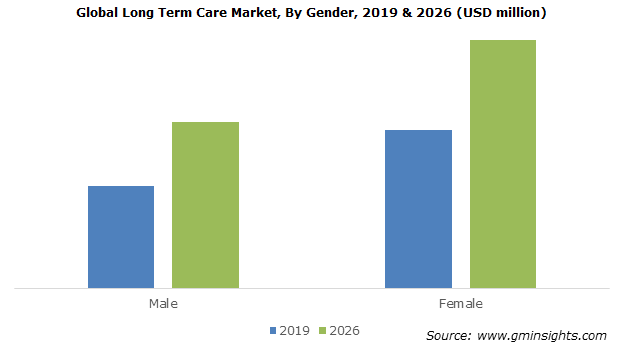

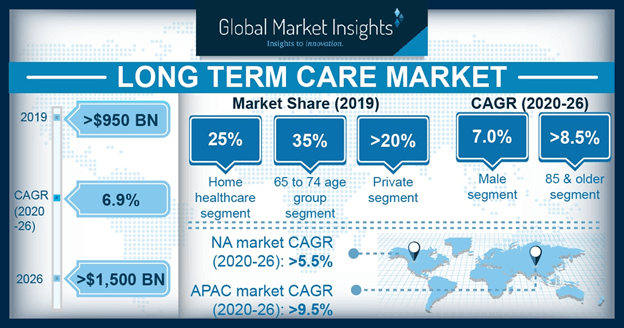

Long Term Care Market Research 2020 2026 Industry Share Report

Long Term Care Market Research 2020 2026 Industry Share Report

Press release - MarketResearchReportsbiz - Long-term-care Insurance Market Share Trends and Forecast 2022.

Long term care insurance market share by company. Also magnify the decision making potentiality and helps to create an effective counter-strategy to gain a competitive advantage. This means an increase in premiums compared to a regular policy. Couples can share long term care benefits through shared care rider.

Of those insurance companies only State Farm also offers Long Term Care Insurance and it is a niche market for them when it comes to market share. The complete study for the Long-Term Care Insurance Market 2020 report presents you analysis of market size share growth trends cost structure statistical and comprehensive data of the global market. As an asset based policy it provides cash indemnity for long-term care services and a lump sum life insurance death benefit.

Availability of Shared Care Rider. This privately-held brokerage firm connects consumers with policies and services from top-rated carriers offering coverages that are tailored to their needs. These numbers reflect that each policyholder has an initial benefit of 164000 with a daily benefit of 150 and a three-year benefit period.

The number of insurance companies selling long-term care insurance has plummeted since 2000. What is Long Term Care Insurance industry in the US. Business By Ashwin Naphade Published.

Diversicare Healthcare Services Inc. Long Term Care Insurance Market Size Share by Company like NerdWallet State Farm GoldenCare Sun Life Financial ACSIA Partners Humana Allstate MassMutual Anthem LTCRplus. Long Term Care Market Share Insights Major players in the market for long term care include Brookdale Senior Living Inc.

For nursing home care throughout ones lifetime. Atria Senior Living Group. Typical terms today include a daily benefit of 160 for nursing home coverage a waiting period of about three months before insurance kicks in and a maximum of three years worth of.

Strikingly Genworth the long-time industry leader that generated nearly one-third of all new premium dollars as recently as 2014 sold only 12 percent in 2016. Then policy is hybrid universal life with a LTC indemnity benefit. For years long-term care insurance entailed paying an annual premium in return for financial assistance if you ever needed help with day-to-day activities such as bathing dressing and eating meals.

Aet Inc Anthem Humana Inc UnitedHealth Group Sun Life Financial -. Top 10 Best Long-Term Care Insurance Companies. Slome is also head of the National Advisory Center for Short-Term Care Information established in 2015 to create awareness for the benefits offered by short-term care insurance products.

The survey results were published. But the benefits you can get are definitely more than what youre going to pay for. Top Long Term Care Insurance Companies.

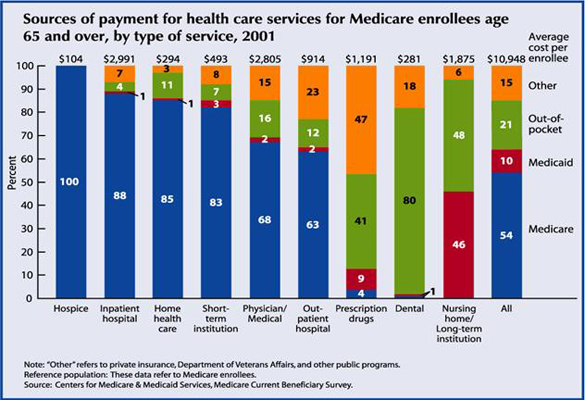

According to the American Association for Long-Term Care Insurance the average cost of long-term care insurance premiums for a healthy married couple both aged 55 costs 4826 per year roughly 400month. However Medicare does not cover LTC provided by either custodial or nonskilled workers but only provides medically necessary care in skilled nursing facilities or if ordered by a doctor rehabilitative care in ones home. Issue ages available from 40-75.

For example for auto and property insurance State Farm is the dominant company followed by major carriers like Progressive Geico Nationwide Allstate etc. Senior Care Centers of America. Also known as National Independent Brokers Inc GoldenCare is an online insurance marketplace that specializes in long-term care insurance critical care insurance and life insurance.

2015s Top-10 Long-Term Care Insurance Companies ranked by lives sold Northwestern Mutual Mutual of Omaha Genworth Financial Transamerica Long Term Care. Nationwide Life Insurance Company- Nationwides linked benefit long-term care insurance is marketed under its YourLife CareMatters. More specifically Medicare Part A will cover up to 90 days.

Home Instead Senior Care Inc and Amedisys Inc. Global Long-Term Care Insurance Market Size Share Trends CAGR by Technology Key Players Regions Cost Revenue and Forecast 2020 to 2025 Category. Long Term Care Insurance in the US industry statistics Biggest companies in the Long Term Care Insurance industry in the US This industry has no major players with a market share of greater than 5.

To top it all it allows couples to purchase shorter policies that are affordable which helps them save more money.

Long Term Care Market Research 2020 2026 Industry Share Report

Long Term Care Market Research 2020 2026 Industry Share Report

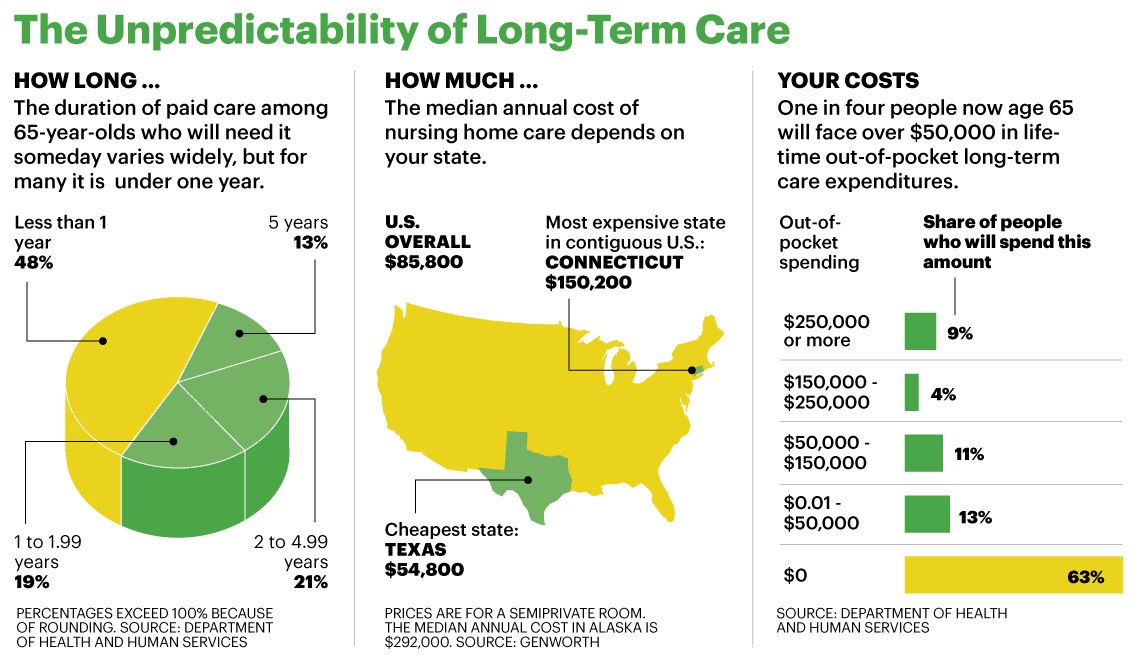

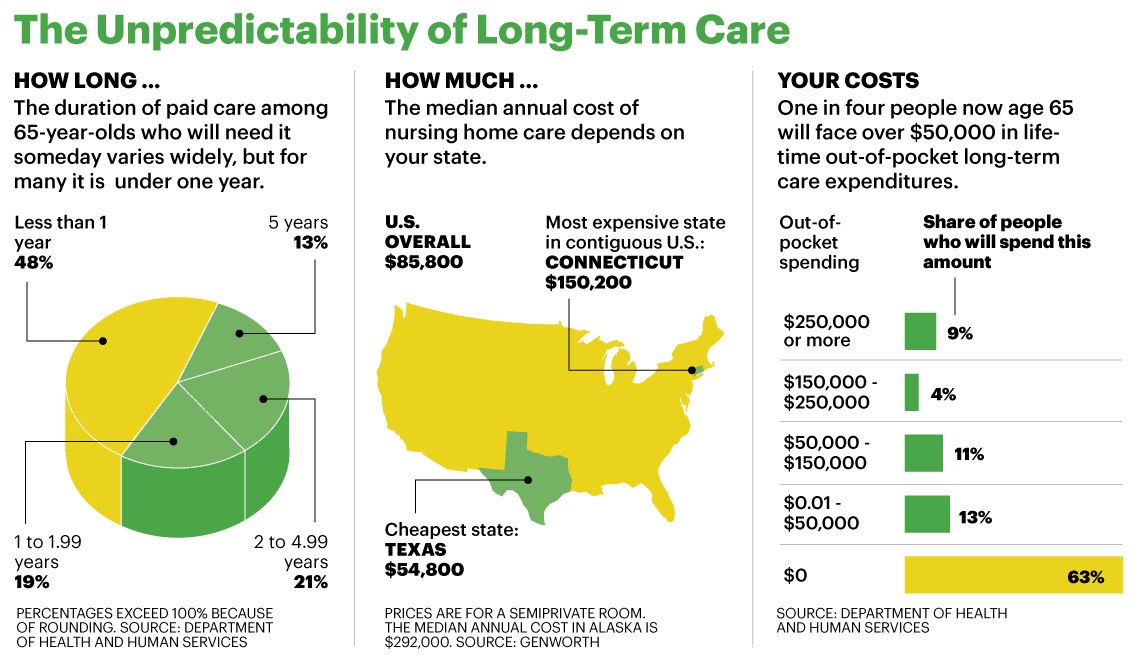

Mistakes To Avoid When Shopping For Long Term Care Insurance Wsj

Mistakes To Avoid When Shopping For Long Term Care Insurance Wsj

Long Term Care Insurance Is It Worth It Wsj

Long Term Care Insurance Is It Worth It Wsj

Long Term Care Insurance Market Demonstrates A Spectacular Growth By 2026 Allstate Unitedhealth Group Massmutual State Farm Investopedia Acsia Partners Menafn Com

Long Term Care Insurance Market Demonstrates A Spectacular Growth By 2026 Allstate Unitedhealth Group Massmutual State Farm Investopedia Acsia Partners Menafn Com

Long Term Care Insurance Market Size Share By Company Like State

Long Term Care Insurance Market Size Share By Company Like State

C The Decision To Exit The Market Aspe

5 Facts You Should Know About Long Term Care Insurance

5 Facts You Should Know About Long Term Care Insurance

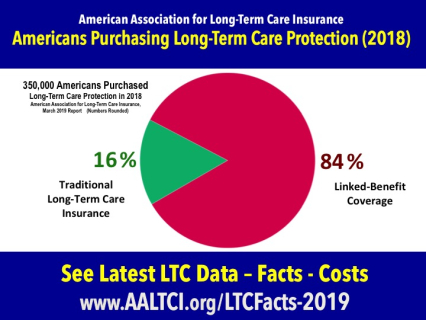

Long Term Care Insurance Statistics Data Facts 2019

Long Term Care Insurance Statistics Data Facts 2019

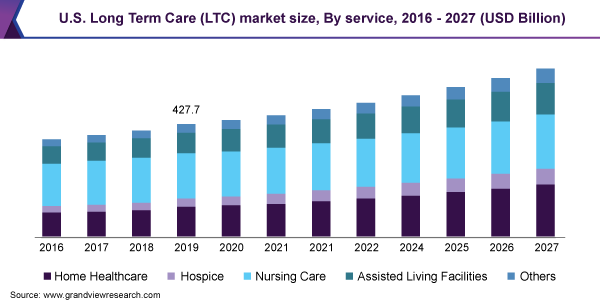

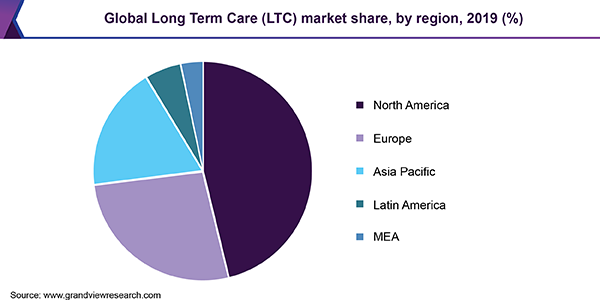

Long Term Care Market Size Share Trend Industry Report 2027

Long Term Care Market Size Share Trend Industry Report 2027

Long Term Care Insurance Market May See A Big Move Major Giants

Long Term Care Insurance Market May See A Big Move Major Giants

Long Term Care Market Size Share Trend Industry Report 2027

Long Term Care Market Size Share Trend Industry Report 2027

Long Term Care Insurance Market Worth Observing Growth

Long Term Care Insurance Market Worth Observing Growth

Long Term Care Market Research 2020 2026 Industry Share Report

Long Term Care Market Research 2020 2026 Industry Share Report

Comments

Post a Comment