Featured

Auto Insurance Trends

Unfortunately industry experts see this trend continuing due to a variety of factors ranging from litigation to deteriorating public roads. Auto insurance hasnt been profitable for carriers for the past decade.

Iot Insurance Trends In Home Life Auto Insurance Industries

THE TOP 5 CAR INSURANCE COMPANIES IN SOUTH AFRICA.

Auto insurance trends. The pandemic changed everything. This included measures of change in consumer behavior carrier response and the impact in general. New Auto Insurance Sources and Providers.

69 of consumers would be willing to have a sensor attached to their car if it would lower their premiums. Auto Insurance Industry Trends. From 2014 to 2019 the US.

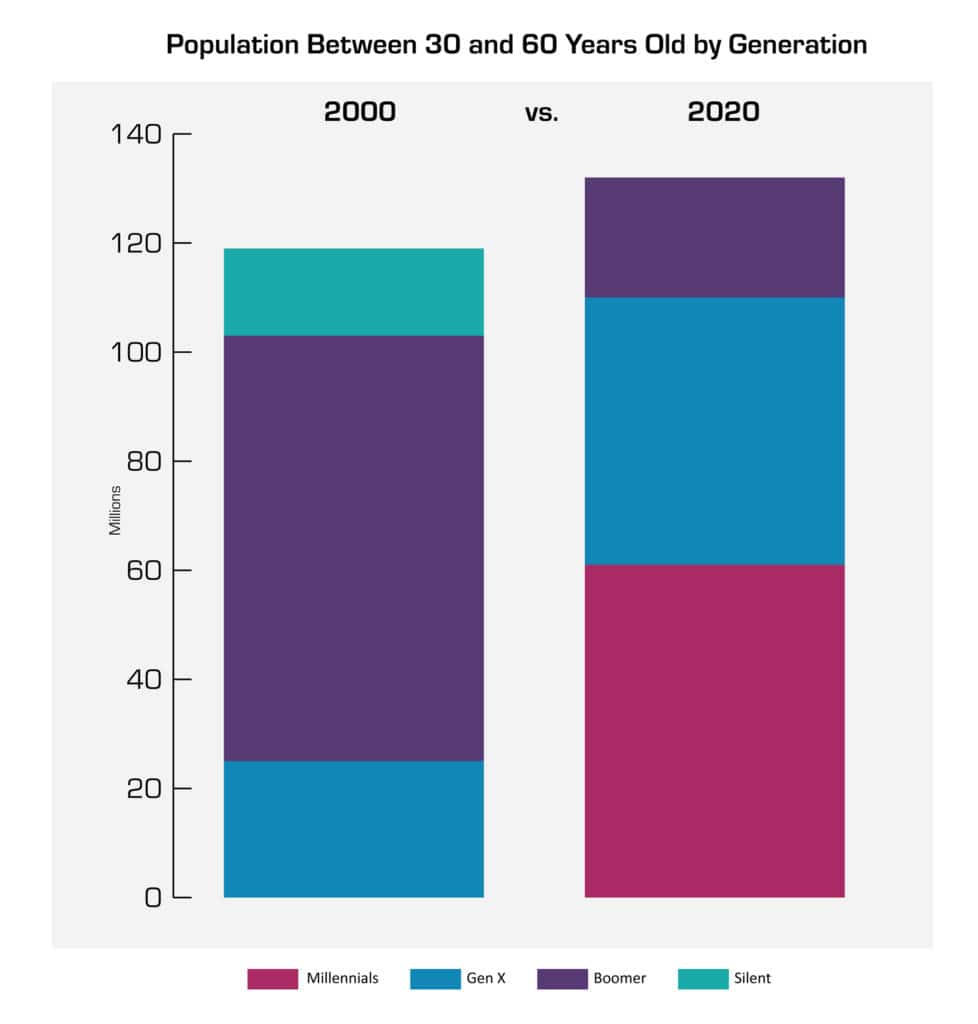

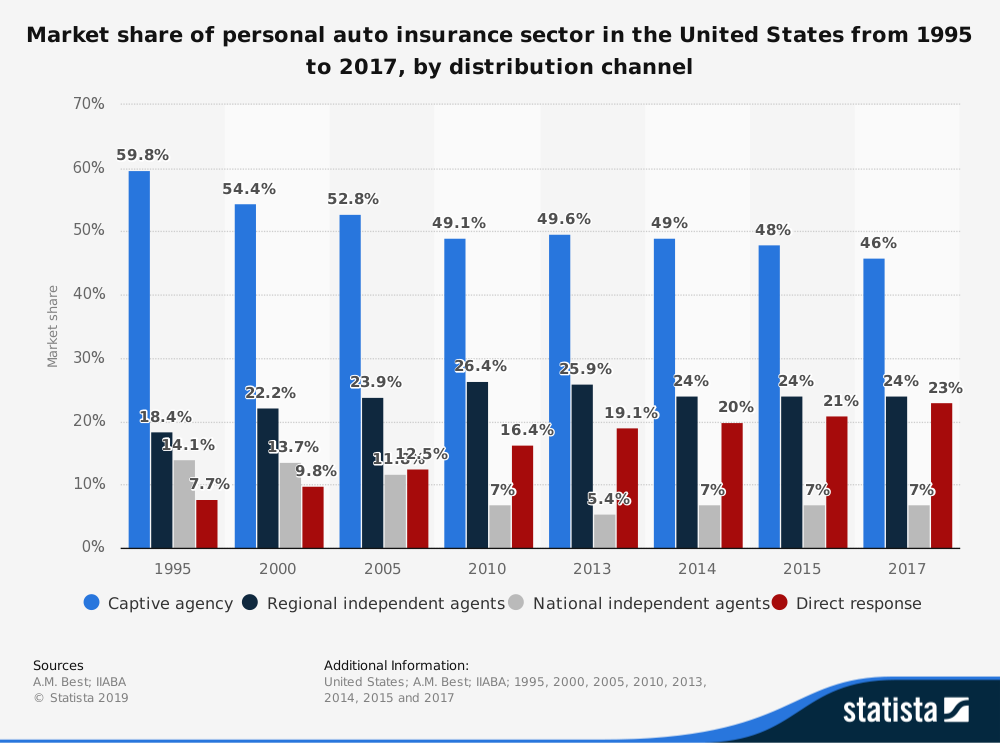

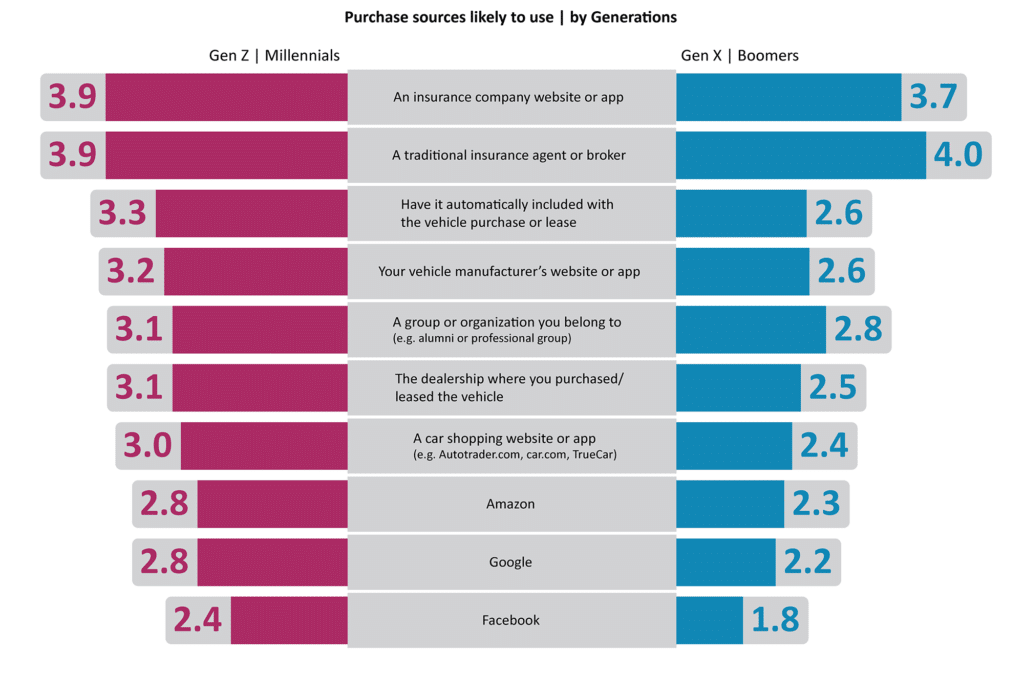

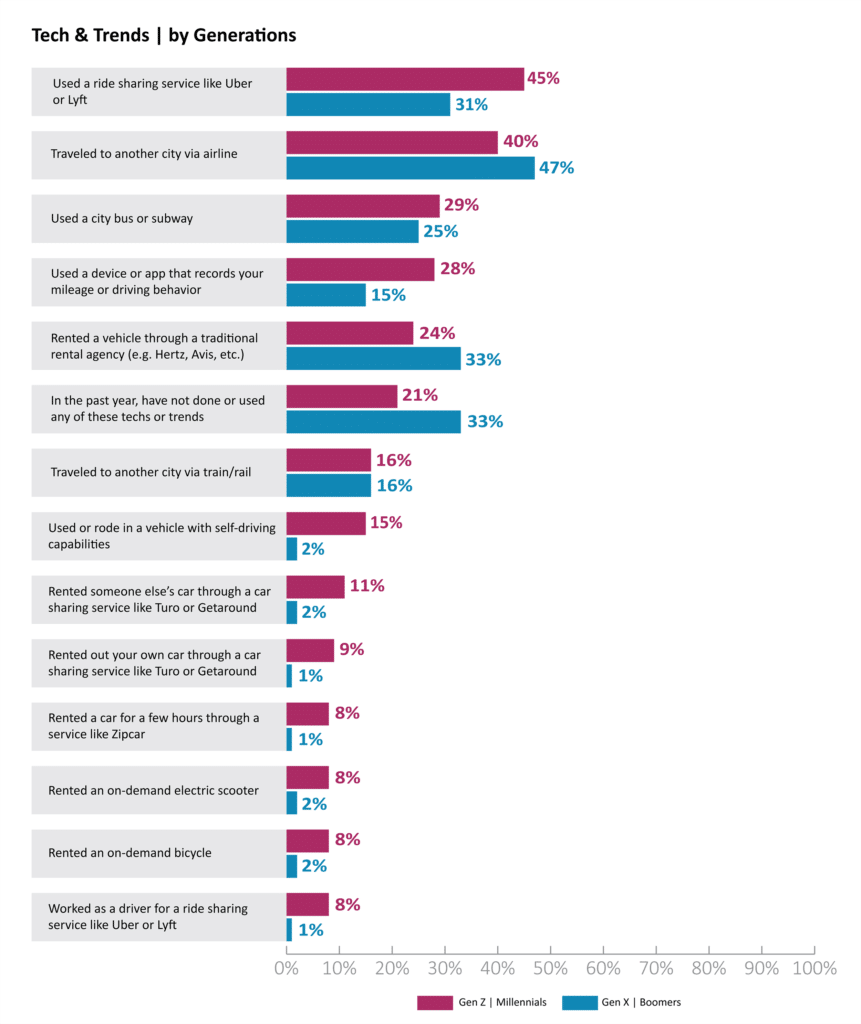

The traditional purchase methods for auto insurance are still the most preferred channels agentsbrokers or direct via an insurers website. This is consistent from the last couple of years from our. The Auto Insurance Buyer A Shifting Demographic.

In addition insurers will be able to generate smart insights to help them transform their offerings and meet Millennials and Gen Zs high expectations for excellent and tailored customer service from all of their service providers - including their auto insurer. Consumer trends in insurance - keeping it closer to home. There will be more uninsured motorists on the road.

Connected devices drivers use are a relatively new data source for auto insurtechs. This has led to premium increases tougher renewals and stricter policies for businesses. Anderson identifies one important trend drivers should be aware of.

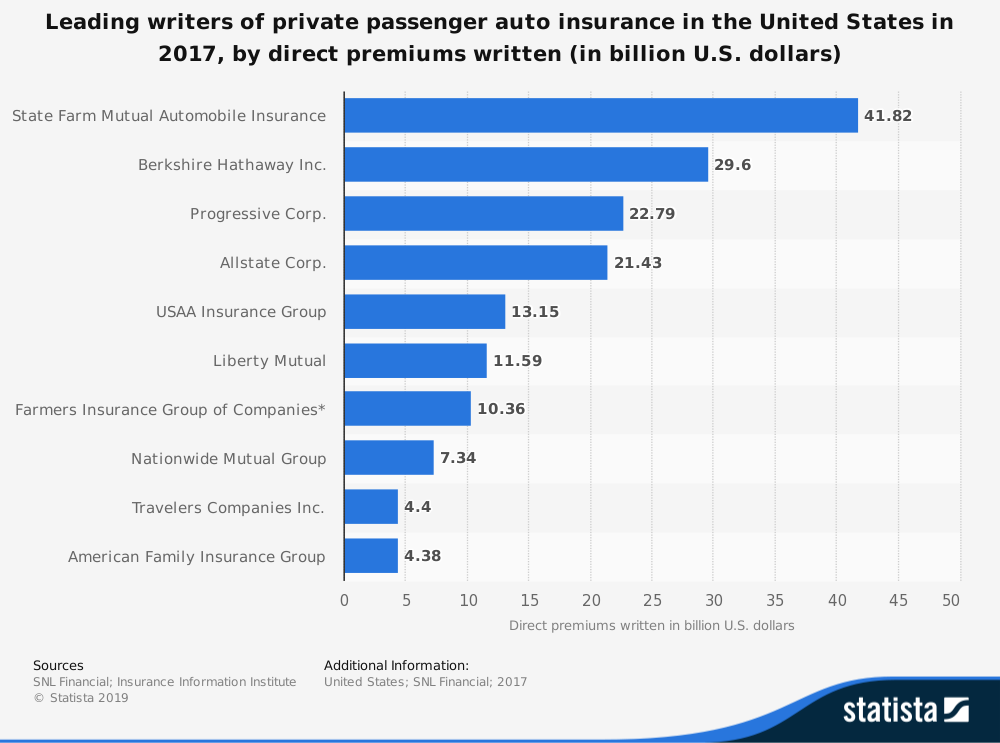

Auto insurance market grew by 12 in 2019. We consider five trending points that are driving change including. Demanding customers new competitors and a changing set of challenges are transforming the insurance industry.

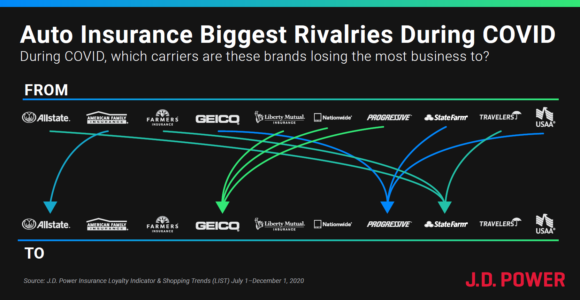

In fact the industry collectively sustained a loss of 4 billion in commercial auto coverage in 2019 according to AM Best. In the 2021 US Auto Insurance Trends report there was an analysis of the 2020 data which provided insight into the impact of the COVID-19 pandemic on this industry. For example auto insurers can partner with OEMs telecommunications operators or digital platforms like Lyft or Uber to be able to provide new hybrid insurance models.

And this disruption is not just digital. The four trends that define insurance in 2020. PwC Based on a PwC survey a large portion of the customer base is in favor of using car sensors particularly if doing so would help them cut costs.

Auto insurance market grew by 33. Lets briefly consider these trends and how they may impact auto insurers. New Auto Insurance Sources and Providers.

On the other hand while many US auto insurers saw a significant loss in premiums after providing policyholders with rebates and rate cuts to reflect less driving during the pandemic carriers may see improved profitability with an expected drop in accident frequency. However short-term effects will be evident as we continue to confront the pandemic. Long-term effects of the pandemics crises on the auto insurance have yet to be seen.

The insurance industry stands on the precipice of profound change. Auto insurance volume fluctuated throughout 2020 and new business policies written fell 104 but overall volumes ended the year 53 higher than the year prior. The report helps insurance carriers to better understand their evolving landscapes.

The automobile insurance industry is projected to generate revenue of 2852 billion in 2019. No wonder IoT which allows usage-based insurance is named one of the major auto. That leads directly to higher premiums andor a greater reluctance to underwrite certain exposures and is yet another factor in the current overall hard insurance market.

Auto Insurance Industry Trends. Three Trends In Auto Insurance To Watch Out For In 2021 Customers will prefer versatile service providers and modular services which means they can pick and choose features according to their needs or their. As the automobile manufacturing industry reaches new technological levels auto insurance providers struggle to keep a high-tech pace with it.

In addition to the fact that in 2021 we will all be staying closer to home due to COVID. Most of the consumers we surveyed said they still own or lease one or more vehicles. Auto Insurance Trends Report 2019 Look to the future to make the right decisions now The Auto Insurance Trends Report explores how trends in shopping driving violations vehicle safety features and industry best practices are impacting many aspects of the auto insurance lifecycleincluding quoting underwriting and claims.

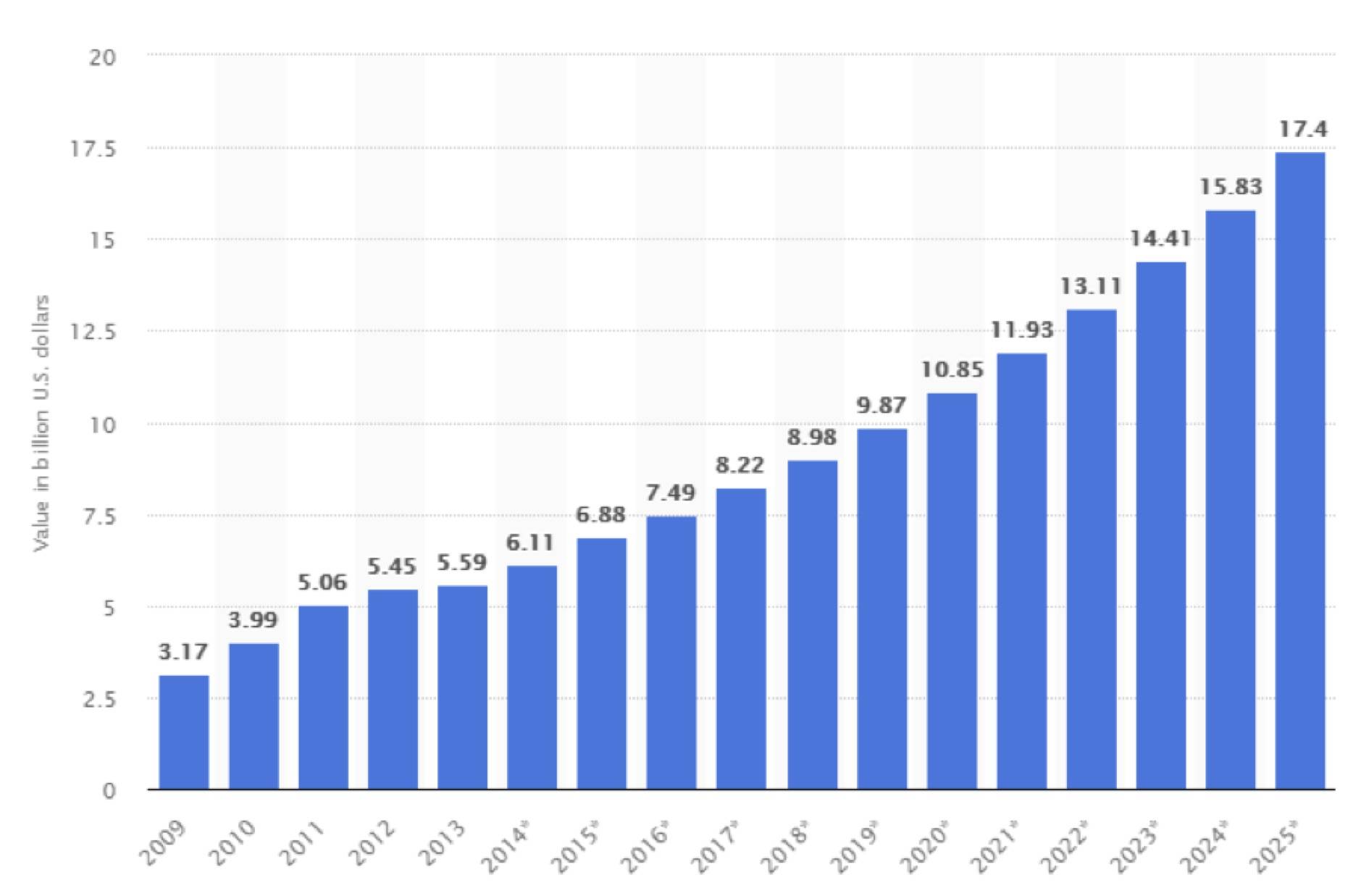

The global auto insurance market grew by 29 from 2010 to 2014 when it reached 6697 billion. Life and annuity sales undercut by pandemic interest rate drop. How the life insurance industry is using AI to attract millennials.

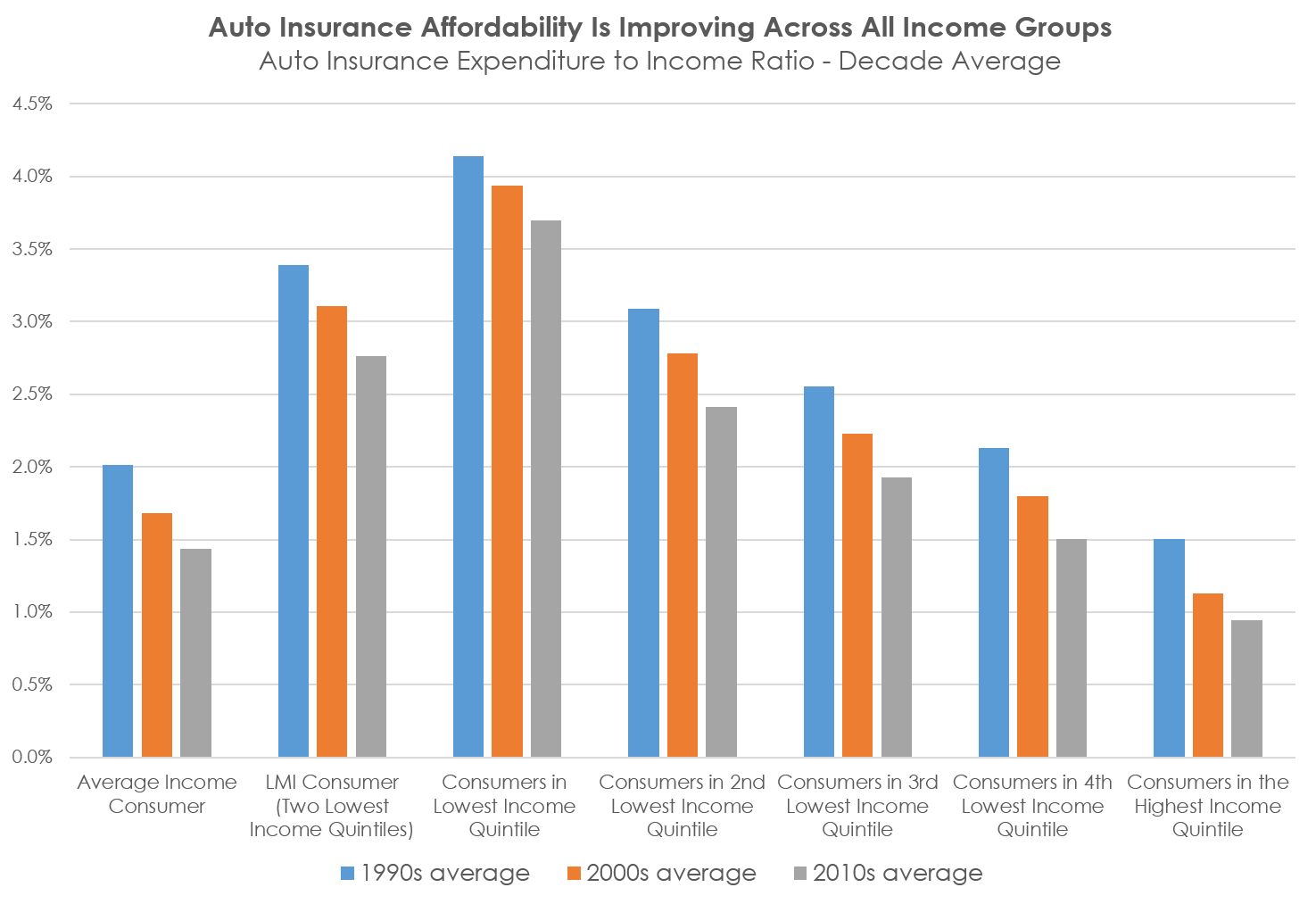

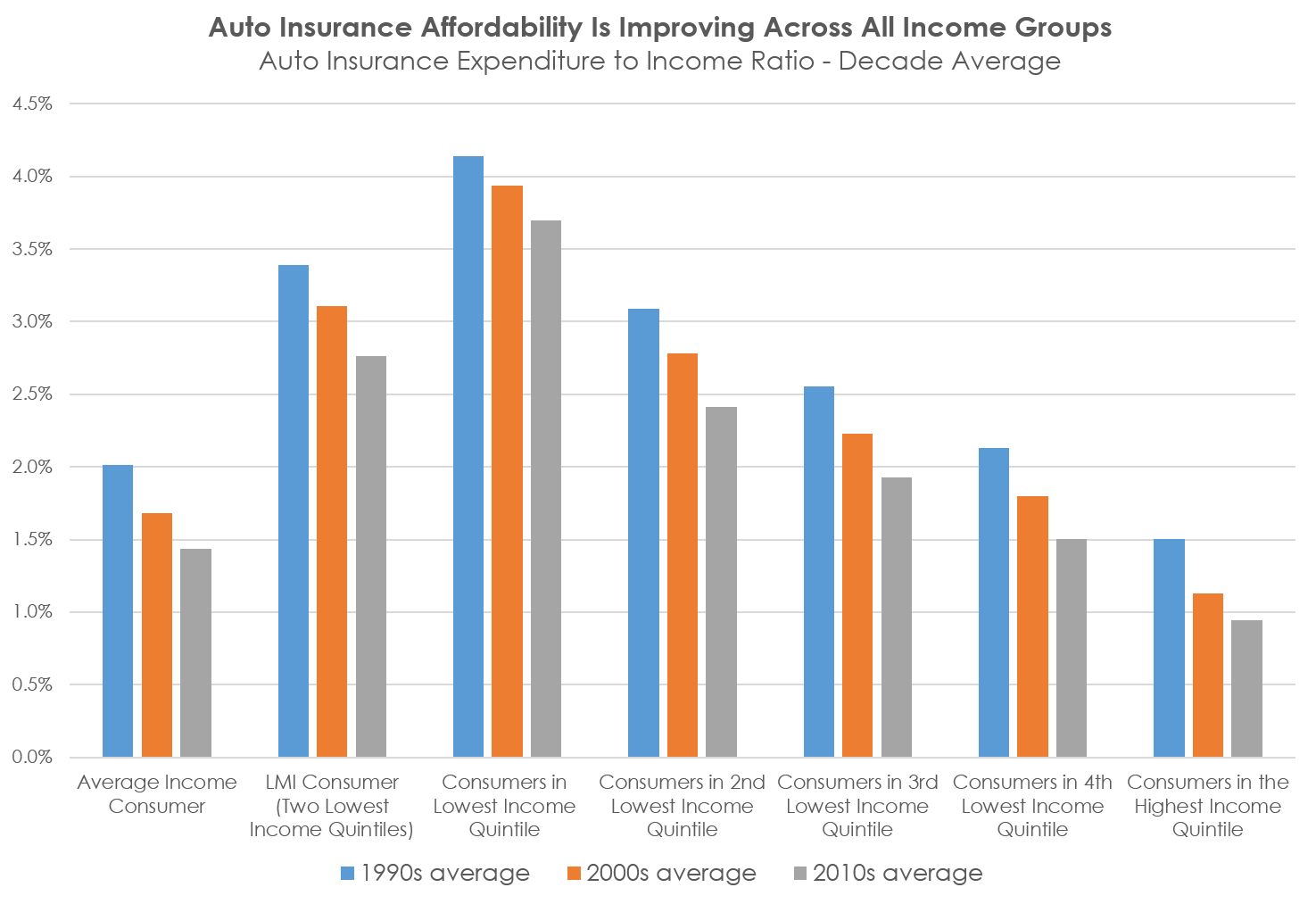

Auto Insurance Affordability Improves In Most States Irc

Auto Insurance Affordability Improves In Most States Irc

Trends In Auto Insurance Affordability Insurance Research Council

Trends In Auto Insurance Affordability Insurance Research Council

5 Trends Impacting Traditional Auto Insurance

5 Trends Impacting Traditional Auto Insurance

4th Look 2019 The Private Passenger Auto Insurance Marketplace In Massachusetts Agency Checklists

4th Look 2019 The Private Passenger Auto Insurance Marketplace In Massachusetts Agency Checklists

Top Performing Auto Insurers During Covid And What S Driving Customer Behavior

Top Performing Auto Insurers During Covid And What S Driving Customer Behavior

Navigating The Road Ahead For Commercial Auto Insurance Gulfshore Insurance

Navigating The Road Ahead For Commercial Auto Insurance Gulfshore Insurance

30 Auto Insurance Industry Trends Facts Statistics 2021

30 Auto Insurance Industry Trends Facts Statistics 2021

31 Car Insurance Industry Statistics Trends Analysis Brandongaille Com

31 Car Insurance Industry Statistics Trends Analysis Brandongaille Com

30 Auto Insurance Industry Trends Facts Statistics 2021

30 Auto Insurance Industry Trends Facts Statistics 2021

5 Trends Impacting Traditional Auto Insurance

5 Trends Impacting Traditional Auto Insurance

31 Car Insurance Industry Statistics Trends Analysis Brandongaille Com

31 Car Insurance Industry Statistics Trends Analysis Brandongaille Com

5 Trends Impacting Traditional Auto Insurance

5 Trends Impacting Traditional Auto Insurance

2019 Trends Disrupt Car Insurance Industry Nuwire Investor

2019 Trends Disrupt Car Insurance Industry Nuwire Investor

30 Auto Insurance Industry Trends Facts Statistics 2021

30 Auto Insurance Industry Trends Facts Statistics 2021

Comments

Post a Comment