Featured

Pledged Asset Loan

Lines of credit and pricing Credit lines are available based on the value of your eligible and pledged securities. A pledged asset reduces the riskof the lender since it can take possession.

Https Pages Genworth Com Rs 703 Nww 341 Images 12296734 Pledgedassets 0817 Pdf

A Pledged Asset Line from Charles Schwab is ideal for current customers looking to take advantage of their investments without selling them.

Pledged asset loan. A pledged asset is an assetthat is being used as collateralon a loan. Lender is added as a creditorbeneficiary of that account which enables us to monitor its value. How to qualify for the Collateral Lending Program.

In some cases the lender may require the borrower to place pledged assets such as cash or securities in a separate account that the lender controls. Some borrowers shy away from a pledged asset mortgage because they assume theyll lose ownership of their valuable possession. Its a PAL pledged asset loan of stock against a condominium which I bought for 125m.

The stock account cannot go below 17m which It hasnt. A pledged asset is collateral pledged by a borrower to a lender usually in return for a loan. The monthly interest rate was prime with minimal which over the last three years has been less than any bank would give me.

Pledged Asset Loan Program Keep your investment strategies safe We offer financing up to 90 of a homes value by pledging cash or cash equivalents in lieu of a down-payment second mortgage or home equity loan. Think of a pledged asset as collateral held by the lender in return for lending you the necessary funds for a home purchase or refinance. As defined by Charles Schwab a Pledged Asset Line is an uncommitted non-purpose securities-based borrowing solution that allows individuals to leverage eligible assets in their investment portfolio as collateral for a secured loan.

Essentially investments are used as collateral to establish a revolving line of credit. They take possession of the collateral sell it and use the sales proceeds to pay off the loan. The amount borrowed is typically between 50 and 70 of a clients diversified investment account portfolio.

I had to pledge 17 M worth of stock and had to keep it at that level for whatever time I wanted. The process of completing a Pledged Asset loan is not difficult but will take some extra work. Schwab Bank in its sole discretion will determine at any time the eligible collateral criteria and the loan value of collateral.

According to Charles Schwab a PAL is an uncommitted non-purpose securities-based borrowing solution that allows individuals to leverage eligible assets in their investment portfolios as collateral for a secured loan In normal language a PAL is a line of credit backed by a taxable investment portfolio. If you pledge an asset as collateral your lender has the right to take action assuming you stop making payments on the loan. Pledged accounts may be considered for release after 36 months at investors sole discretion New appraisal must reflect pledged LTV at time of release request must be equal to or less than original effective LTV Borrower must be current on loan payments with no delinquencies in the last 12 months to qualify for pledge release.

What is a Pledged Asset Line PAL. You can use the loan proceeds freely other than to purchase more. Procedurally a new account is created at the institution where the assets are located and the assets are then moved into this account.

This program is ideal for clients who wish to purchase real estate while maintaining their current investment strategy. Pledged Loan means any Loan made by the Company with respect to which the Banks have made an Advance or with respect to which the Company has requested an Advance unless such Request for Advance is rejected by the Agent or which is now or hereafter at any time pledged assigned transferred or conveyed or a security interest therein granted to the Agent for the benefit of the Banks. A Pledged Asset Line from Schwab Bank is a flexible non-purpose line of credit¹ that lets you leverage the value of your portfolio.

There are no set-up fees and your line will have a flexible repayment schedule with no set term. You can borrow against up to 20 million in investments held in a Pledged Account. Secured by assets held in a separate Pledged Account maintained by Charles Schwab Co Inc you can use your line of credit to access the funds you need while helping maintain your investing strategy.

Schwab Bank requires that the assets pledged as collateral for the Pledged Asset Line be held in a separate Pledged Account maintained at Charles Schwab Co Inc. This notion couldnt be. The lender has the right to seize the collateral if the borrower defaults on the obligation.

/joint-loans-overview-315512_final-19175f1cf9844ee0a7a2646f500e72b3.png) Joint And Shared Ownership Loans For Multiple Borrowers

Joint And Shared Ownership Loans For Multiple Borrowers

Hawaii Pledged Asset Loan From Pacific Home Loans

Hawaii Pledged Asset Loan From Pacific Home Loans

:max_bytes(150000):strip_icc()/collateral-loans-315195-v3-5bc4cbf746e0fb002693d842.png) Using Collateral Loans To Borrow Against Your Assets

Using Collateral Loans To Borrow Against Your Assets

Pledged Asset Mortgage Loans Truss Financial Group

Pledged Asset Mortgage Loans Truss Financial Group

What Is A Pledged Asset Mortgage Pam American Financing

What Is A Pledged Asset Mortgage Pam American Financing

Charles Schwab Pledged Asset Line Review 2021 Finder Com

Charles Schwab Pledged Asset Line Review 2021 Finder Com

Pledged Asset Line Pal Borrow From Your Investment Portfolio

Pledged Asset Line Pal Borrow From Your Investment Portfolio

The Rich Man S Secret Mortgage The Pledged Asset Loan Drew De La Houssaye Realtor C

Pledged Asset Loan Pal Central Pa Chamber Of Commerce

Pledged Asset Loan Pal Central Pa Chamber Of Commerce

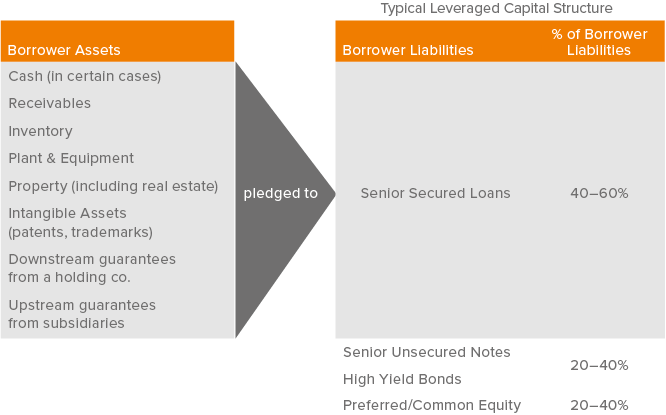

What Is Asset Based Lending The Ultimate Guide

What Is Asset Based Lending The Ultimate Guide

Pledged Asset Feature On First Mortgage Loans

Pledged Asset Feature On First Mortgage Loans

Pledged Asset Loan Is The Solution To Your Monetary Problem The Cash Academy

Diversify Your Portfolio With Senior Loans

Diversify Your Portfolio With Senior Loans

Pledge Asset Mortgage Offered By Morgan Stanley Private Bank

Pledge Asset Mortgage Offered By Morgan Stanley Private Bank

Comments

Post a Comment